Understanding MCA Cash Advance

What is MCA Cash Advance?

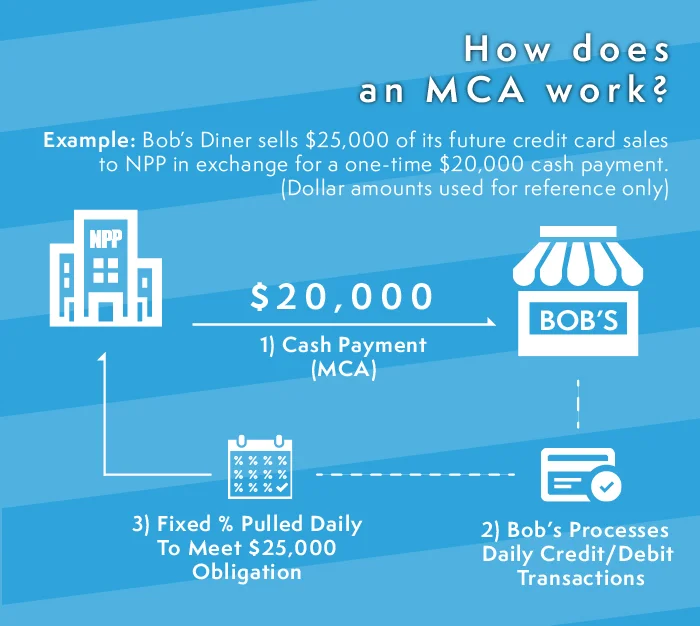

MCA cash advance stands for Merchant Cash Advance. It is a type of funding that is provided to businesses based on their future credit card sales. This form of financing is popular among small businesses that may not qualify for traditional bank loans due to poor credit history or lack of collateral.

How does MCA Cash Advance Work?

When a business owner applies for an MCA cash advance, the lender will review the business’s credit card sales history to determine the amount of funding that can be provided. Once approved, the business owner will receive a lump sum payment which is repaid through a percentage of their daily credit card sales.

What is known about MCA Cash Advance?

Image Source: squarespace-cdn.com

MCA cash advance is known for its quick and easy approval process. Unlike traditional bank loans that may take weeks to process, MCA cash advances can be approved within a few days. This makes it an attractive option for businesses in need of immediate funding.

Solution for businesses

Businesses that are struggling with cash flow issues or need funding for expansion can benefit from MCA cash advances. Since the repayment is based on a percentage of daily credit card sales, businesses do not have to worry about making fixed monthly payments that may strain their finances.

Information about MCA Cash Advance

It is important for business owners to carefully review the terms and conditions of an MCA cash advance before accepting the funding. While it can provide quick access to capital, the fees and interest rates associated with MCA cash advances are typically higher compared to traditional bank loans.

Conclusion

Image Source: cloudfront.net

In conclusion, MCA cash advance can be a useful tool for businesses in need of quick funding. However, it is important for business owners to understand the terms and conditions of the funding to avoid any financial pitfalls. With proper planning and management, MCA cash advance can help businesses navigate through cash flow challenges and achieve their growth objectives.

FAQs

1. Is MCA cash advance suitable for all types of businesses?

MCA cash advance is more suitable for businesses that have a high volume of credit card sales. Businesses that rely heavily on cash transactions may not benefit from this type of funding.

2. Can I apply for an MCA cash advance if my credit score is low?

Yes, MCA cash advances are available to businesses with poor credit history. The lender will focus more on the business’s credit card sales history rather than the owner’s personal credit score.

3. How long does it take to repay an MCA cash advance?

The repayment period for an MCA cash advance is typically shorter compared to traditional bank loans. The duration can range from a few months to a year, depending on the agreement with the lender.

4. Are there any hidden fees associated with MCA cash advances?

It is important for business owners to carefully review the terms and conditions of the MCA cash advance agreement to understand any additional fees that may be charged. Transparency is key to avoiding any surprises.

5. Can I apply for multiple MCA cash advances at the same time?

While it is possible to have multiple MCA cash advances at the same time, it is important to assess the repayment terms and ensure that the business can handle the financial obligations. It is recommended to consult with a financial advisor before taking on multiple cash advances.

mca cash advance