Money Lenders for Business

What do you mean by money lenders for business?

Money lenders for business are individuals or entities that provide financial assistance to businesses in the form of loans or lines of credit. These lenders can be traditional banks, online lenders, private investors, or alternative financing companies. Business owners often turn to money lenders when they need capital to start a new venture, expand an existing business, or cover unexpected expenses.

How do money lenders for business operate?

Money lenders for business typically evaluate the creditworthiness and financial stability of a business before deciding to lend money. They may require business owners to submit financial statements, business plans, and other documentation to assess the risk of the loan. Once approved, the lender will provide funds to the business, which must be repaid with interest over a predetermined period of time.

What is known about money lenders for business?

Image Source: licdn.com

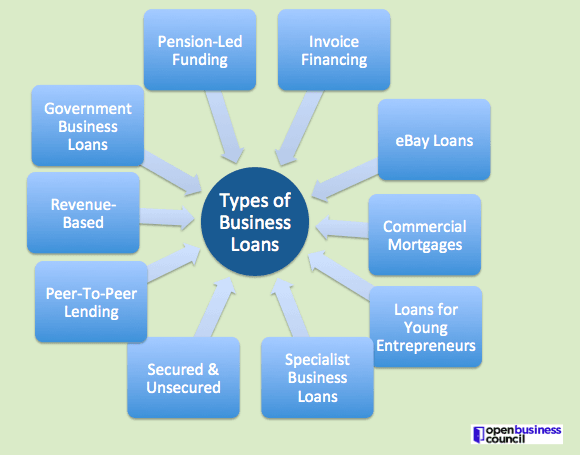

Money lenders for business offer a variety of loan options, including term loans, lines of credit, equipment financing, and merchant cash advances. Each type of loan has its own terms and conditions, interest rates, and repayment schedules. Business owners should carefully consider their financing needs and goals before choosing a lender and loan product.

Solution for business owners seeking financing

For business owners seeking financing, it’s important to research and compare different money lenders to find the best fit for their needs. Factors to consider include the lender’s reputation, interest rates, fees, loan terms, and customer service. Business owners should also review their own financial situation and determine how much money they need to borrow and how they plan to use the funds.

Information on choosing the right money lender for your business

When choosing a money lender for your business, it’s essential to consider the following factors:

Image Source: amazonaws.com

Reputation: Look for lenders with a positive reputation and good reviews from other business owners.

Interest rates: Compare interest rates from different lenders to ensure you’re getting a competitive rate.

Loan terms: Review the terms and conditions of the loan, including repayment schedule, fees, and penalties.

Customer service: Choose a lender that provides excellent customer service and support throughout the loan process.

Conclusion

In conclusion, money lenders for business play a crucial role in helping businesses access the capital they need to grow and succeed. By understanding how money lenders operate, researching different lenders, and choosing the right financing option for their needs, business owners can secure the funding they need to achieve their goals.

FAQs

1. How do I qualify for a business loan from a money lender?

To qualify for a business loan from a money lender, you typically need to have a strong credit history, stable business revenue, and a solid business plan. Lenders may also require collateral or a personal guarantee.

2. What are the advantages of borrowing from money lenders for business?

Some advantages of borrowing from money lenders for business include quick access to funds, flexible loan options, and the ability to finance major expenses or projects.

3. Are there any risks associated with borrowing from money lenders for business?

Some risks of borrowing from money lenders for business include high interest rates, fees, and penalties for late payments. It’s essential to carefully review the terms and conditions of the loan before borrowing.

4. Can I negotiate the terms of a business loan with a money lender?

Yes, you may be able to negotiate the terms of a business loan with a money lender, especially if you have a strong credit history and a solid business plan. It’s important to be prepared and willing to discuss your needs and financial situation.

5. How can I find reputable money lenders for my business?

To find reputable money lenders for your business, consider asking for recommendations from other business owners, researching online reviews, and comparing rates and terms from different lenders. It’s also a good idea to check with industry associations and financial institutions for referrals.

money lenders for business