Cash Advance Commercial

What do you mean by cash advance commercial?

A cash advance commercial is a type of lending activity where a business borrows a sum of money from a financial institution or lender with the agreement that the borrowed amount will be repaid with interest over a specified period of time. This type of loan is often used by businesses to cover short-term expenses, such as payroll, inventory purchases, or equipment repairs.

How does a cash advance commercial work?

In a cash advance commercial transaction, a business owner applies for a loan from a lender, providing information about their business and financial standing. The lender then evaluates the application and determines the amount of money that can be borrowed and the terms of repayment, including the interest rate and repayment schedule. Once the loan is approved, the business receives the funds and is responsible for repaying the loan according to the agreed-upon terms.

What is known about cash advance commercial?

Image Source: dmcdn.net

Cash advance commercials are typically short-term loans that are intended to provide businesses with quick access to cash when needed. These loans often have higher interest rates than traditional bank loans, as they are considered to be higher risk for lenders. However, cash advance commercials can be a valuable tool for businesses that need immediate funds to cover expenses and maintain operations.

Solution for cash advance commercial

Before taking out a cash advance commercial, businesses should carefully consider their financial situation and the terms of the loan. It is important to understand the total cost of borrowing, including interest rates and any fees associated with the loan. Businesses should also have a clear plan for repaying the loan on time to avoid additional fees or penalties. By carefully evaluating their options and choosing a reputable lender, businesses can use cash advance commercials to their advantage.

Information about cash advance commercial

There are several types of cash advance commercials available to businesses, including merchant cash advances, invoice financing, and term loans. Each type of loan has its own requirements and terms, so businesses should carefully research their options before applying. It is also important to work with a trusted lender who offers transparent terms and competitive rates. By being informed and prepared, businesses can make the most of cash advance commercials to support their growth and success.

Conclusion

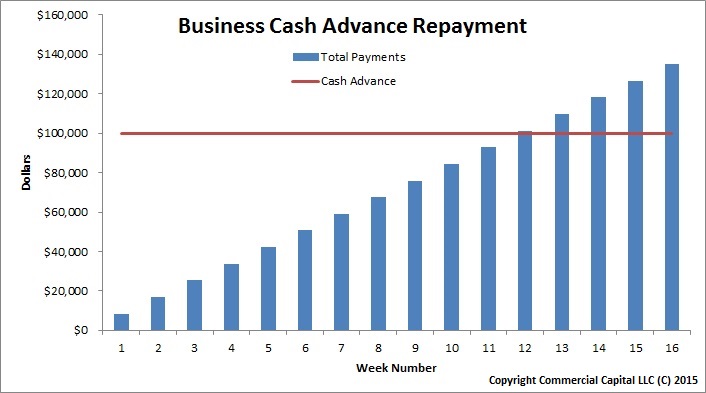

Image Source: comcapfactoring.com

In conclusion, cash advance commercials can be a valuable tool for businesses in need of short-term funding. By understanding how these loans work, evaluating their options, and working with reputable lenders, businesses can use cash advance commercials to cover expenses, maintain operations, and support growth. With careful planning and responsible borrowing, businesses can leverage cash advance commercials to their advantage.

FAQs

1. Can any business qualify for a cash advance commercial?

Businesses must meet certain requirements, such as having a steady revenue stream, to qualify for a cash advance commercial.

2. How quickly can funds be obtained through a cash advance commercial?

Funds from a cash advance commercial can typically be obtained within a few days of approval.

3. What are the main differences between a cash advance commercial and a traditional bank loan?

Cash advance commercials tend to have higher interest rates and shorter repayment terms than traditional bank loans.

4. Are there any risks associated with taking out a cash advance commercial?

Businesses should be aware of the potential for high interest rates and fees with cash advance commercials, as well as the risk of default if the loan is not repaid on time.

5. How can businesses determine if a cash advance commercial is the right choice for their financial needs?

Businesses should carefully evaluate their financial situation, the terms of the loan, and their ability to repay the loan on time before deciding if a cash advance commercial is the best option for their needs.

cash advance commercial