PayPal Lending Money: Everything You Need to Know

What do you mean by PayPal lending money?

PayPal lending money refers to the financial service offered by the popular online payment platform where businesses can borrow money to fund their operations. PayPal provides small business loans, working capital loans, and other financial products to help businesses grow and succeed.

How does PayPal lending money work?

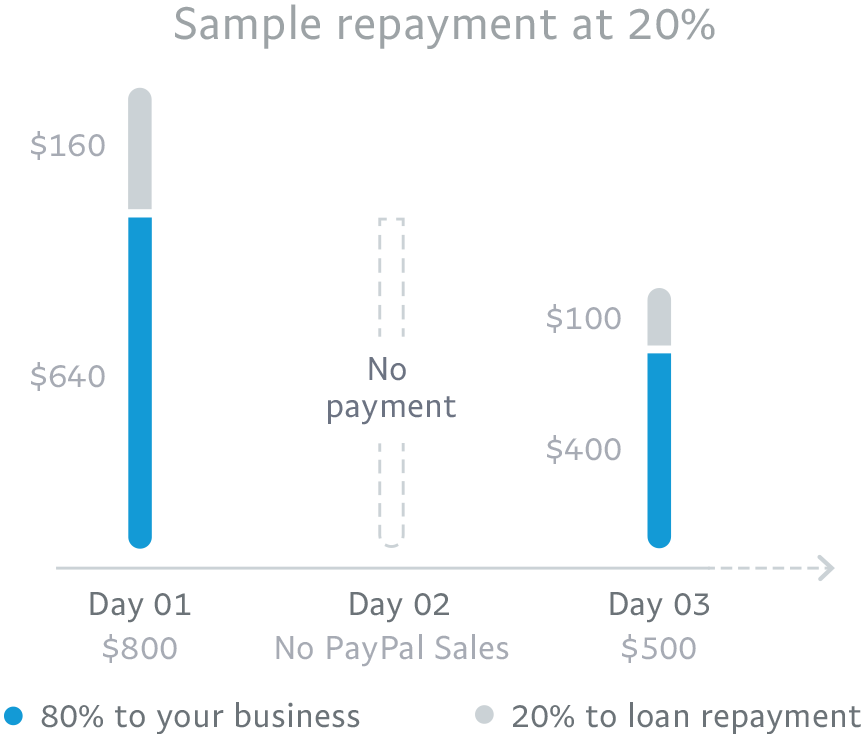

PayPal lending money works by offering loans to businesses based on their sales history and other factors. Businesses can apply for a loan through their PayPal account and get approved quickly. Once approved, the loan amount is deposited directly into the business’s PayPal account, and repayments are automatically deducted from sales made through PayPal.

What is known about PayPal lending money?

Image Source: paypalobjects.com

PayPal lending money is known for its convenience and quick approval process. Businesses can apply for a loan online without the need for extensive paperwork or a lengthy approval process. PayPal uses data from the business’s PayPal account to assess creditworthiness and determine loan eligibility.

What is the solution offered by PayPal lending money?

The solution offered by PayPal lending money is access to quick and easy financing for small businesses. PayPal loans can help businesses cover expenses, expand operations, purchase inventory, or invest in marketing efforts. The repayment terms are flexible, and businesses only pay back the loan when they make sales through PayPal.

Information about PayPal lending money:

PayPal lending money offers loans ranging from $1,000 to $500,000, with repayment terms of up to 18 months. The interest rates and fees vary based on the loan amount and the business’s creditworthiness. PayPal also offers working capital loans, which are based on the business’s PayPal sales history.

Image Source: ytimg.com

Businesses can apply for a loan through their PayPal account and receive approval within minutes. Funds are typically deposited into the business’s PayPal account within one business day. Businesses can track their loan balance, repayment schedule, and other details through their PayPal account dashboard.

Conclusion:

In conclusion, PayPal lending money is a convenient and flexible financing option for small businesses. With quick approval times, flexible repayment terms, and access to capital based on sales history, businesses can use PayPal loans to grow and expand their operations. PayPal lending money provides a valuable financial solution for businesses looking to fund their growth and achieve their goals.

FAQs about PayPal lending money:

1. How can I apply for a loan through PayPal?

You can apply for a loan through your PayPal account by visiting the Business Loans section and following the application process.

2. What are the eligibility requirements for a PayPal loan?

The eligibility requirements for a PayPal loan include having a PayPal business account, a minimum sales volume, and a good credit history.

3. What is the interest rate for PayPal loans?

The interest rate for PayPal loans varies based on the loan amount, repayment term, and the business’s creditworthiness.

4. Can I repay a PayPal loan early?

Yes, you can repay a PayPal loan early without any prepayment penalties. Early repayment can help you save on interest costs.

5. Are PayPal loans suitable for startups?

PayPal loans are typically more suitable for established businesses with a sales history. Startups may have limited access to PayPal loans due to the lack of sales data.

paypal lending money